Resolving issues expats face when it comes to planning pension investments

Making the most of your retirement savings is crucial if you want to build a nest egg that will withstand the risks of inflation, market turmoil and your unexpected longevity. And for many expatriates this means creating and contributing to a pension plan.

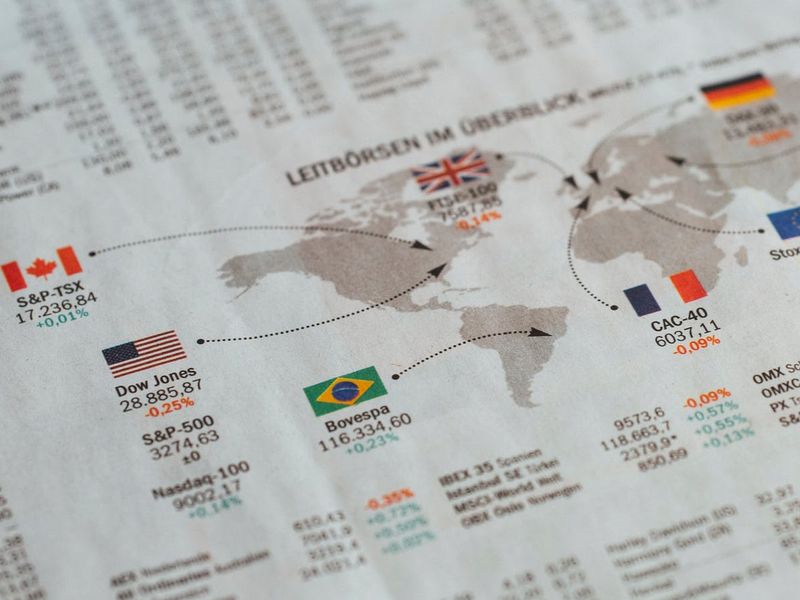

But it has become evident that there are way too many expat pension options available out there as a result of major changes to international pension legislation over recent years.

A wider range of options brings greater complexity, which makes it vital you get the advice that’s right for you – before, at and during your retirement. This is why we look to disentangle the concept below.

With that in mind, one should also be mindful of the leering risks that expats worldwide face when it comes to investing in retirement schemes.

Expat problems with pension planning

Saving for retirement as an expatriate can be a challenging exercise, given that employees can be posted to several different countries throughout the course of their careers.

More often than not, each country has different pension fund legislation, coupled with diverse tax regimes that act as barriers to the portability of pension funds.

While expat salaries tend to be at the higher end of the scale, very often the package does not include a pension scheme as this is not a statutory requirement in many countries.