They should wait for the next dip even if it is only a marginal one

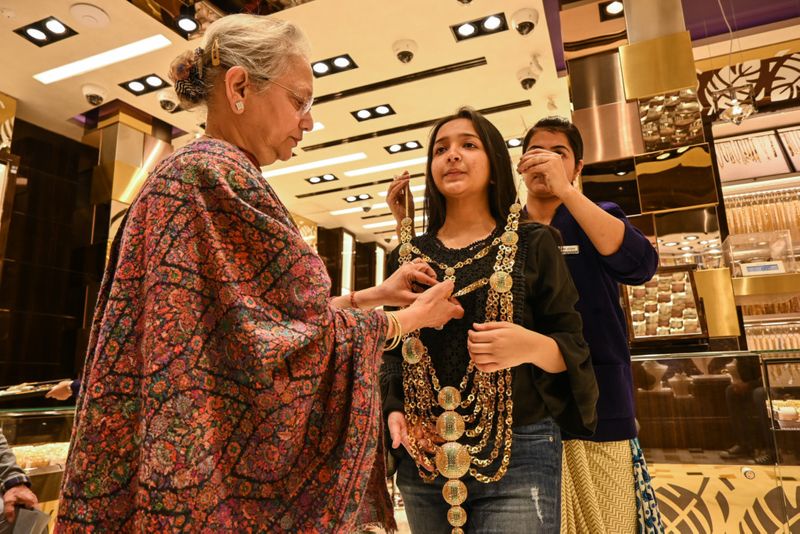

Dubai: After a month when gold prices shot past $1,600 an ounce, before dropping to $1,580 levels, UAE shoppers are still waiting for the right opportunity to get back into buying. The only question is when’s the right time.

“A shopper who typically spends Dh10,000 a year on gold purchases will not hold back forever because prices are high,” said Anil Dhanak, Managing Director at Kanz Jewels. “She will still spend that budgeted amount – only the weight in grams will be less. Gold shoppers are used to that.”

But how gold prices fared all through January would have created doubts even in the most committed buyers. It started the year at $1,518 an ounce, then following the flare up in US-Iran tensions pushed its way past $1,600 for the first time in years, and then settled down to under $1,550. Then came the China virus, and now prices are again at the $1,580 levels.

Compare this with the average price in the final three months of 2019 – $1,481 an ounce. Incidentally, this was the highest quarterly average since the first quarter of 2013, and which led to the drastic drop in shopper purchases during the final weeks of 2019.

At these elevated levels, shoppers will wait awhile and then return. John Mulligan, Head of Member and Market Relations at World Gold Council, certainly believes this will be the case.

For latest gold and remittance rates

“People see an elevated price, especially when it touches record levels, and hold back,” said Mulligan. “But they will not necessarily hold back for the whole of 2020. Some of the in the consumer market needn’t remain right through the year.

“We may see some strengths return to the gold bar and coin market whenever consumer confidence is able to recover.”

On Wednesday, World Gold Council released the 2019 global gold market update, which shows jewellery demand in the UAE dropping 6 per cent to 34 tonnes, against 36.2 tonnes a year ago. (The world top two gold consuming markets – China and India – too showed drops, by 8 and 9 per cent, respectively, to 681.1 tonnes and 544.6 tonnes. Just in the fourth quarter of 2019, these two markets accounted for 80 per cent of the year-on-year decline in jewellery and retail investment demand.)

“Widespread weakness in demand across the region (Middle East) was primarily a response to the higher gold price, particularly as consumers in these markets continued to face economic and geopolitical challenges,” the WGC reports.

What should UAE shoppers do

Be patient – “It’s ideal to buy at any dip that shows up – but don’t keep waiting for a big drop,” said Cyriac Varghese, General Manager at Sky Jewellery. “The trend for gold is prices to remain high this year.”

Jewellery retailers say they are not seeing too much of jewellery exchanges, where shoppers bring in their old pieces for new. Clearly, $1,550 and over will need getting adjusted to. Through the better part of this month, the Dubai gold rate for 22K was stuck at Dh170 a gram and over.

So, who’s buying

It’s been central banks and global funds that are snapping up gold, and each time there is any uncertainty on the economic front, they pick up more. According to Mulligan, “Institutional investors, be it central banks or exchange traded funds (ETFs), will the immediate driver this year as well. But it’s not as simple as saying that this would be the only theme in the gold market.”

Total investment demand – that’s essentially driven by funds – grew 9 per cent to 1,271.7 tonnes in 2019. At a time when gold was soaring, these were the only buyers around.

Alistair Hewitt, Head of Market Intelligence at World Gold Council, says as much: “Demand for gold-backed ETFs surged as investors sought to diversify their portfolios and hedge against uncertainty in other markets. These inflows, along with a sharp increase in futures positioning, saw the US dollar gold price reach a six-year high.

“Looking ahead, we expect gold’s safe haven qualities to remain at the forefront of investors’ minds as they navigate global tensions, low yields, and stretched equity valuations.”

But whenever gold turns into a safe haven asset, it’s never good news for any gold shopper. For her, it’s a question of waiting for the next dip to come around.