BoE likely to boost quantitative easling to help economy through COVID

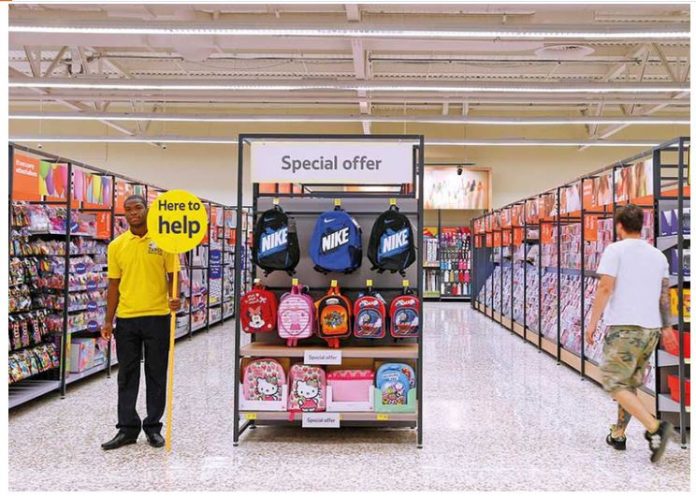

A Tesco supermarket in Watford. British inflation fell to its lowest since June 2016 last month as the coronavirus pandemic sucked demand from the global economy and oil prices tumbled.

Samuel Tombs of Pantheon Macroeconomics forecast that inflation would hover around zero for the rest of the year.

“The outlook for extremely low inflation, then, fully justifies the MPC announcing more quantitative easing at tomorrow’s meeting,” he said.

Britain’s economy suffered a record slump of more than 20% in April due to the closure of non-essential businesses to the public to slow the spread of COVID-19.

Last month the BoE said weaker demand, lower oil prices and a regulatory cap on household energy and water bills, were likely to keep inflation below 1% for several months.

The ONS was unable to collect prices on 14% of the goods and services it normally would because of the lockdown — including drinks at pubs, haircuts and foreign holidays — though some items such as takeaway coffee did become available again.

Major factors pushing down on inflation in May included fuel, clothing and transport costs.

Prices for fuel and lubricants showed their biggest annual fall on record, down 16.7%, while clothing prices were 3.1% lower, the biggest drop since July 2010.

Prices fell for toys and games after they spiked in April as families looked for new ways to keep themselves entertained.